On May 10th, 2022, the Centers for Medicare and Medicaid Services (CMS) published the proposed rule for the fiscal year (FY) 2023 Hospital Inpatient Prospective Payment System (IPPS) in the Federal Register. The rule affects discharge dates on or after October 1, 2022.

Each year, CMS publishes updates to the regulations and payment calculations adjusting for inflation factors, wage index adjustments, and other patient care related payment adjustments.

Below is an overview of the FY 2023 IPPS, including proposed changes and other relevant updates.

Proposed Changes for Acute Care Hospitals

CMS proposes the following updates, payment policies, and payment rates.

Hospital Market Basket

CMS proposes a 3.2% increase in IPPS operating payments for general acute care hospitals that successfully participate in the quality reporting and are meaningful users of electronic health records (EHR).

This includes an estimated market basket update of 3.1%, reduced by a 0.4% productivity adjustment and increased by a 0.5% adjustment directed by legislation.

While this is estimated to result in increased payments of approximately $1.6 billion for FY 2023, CMS is also projecting some significant payment decreases. This includes an estimated decrease of $800 million in disproportionate share payments and uncompensated care (UC) payments combined. It also includes an estimated decrease in payments of $800 million for inpatient cases involving new medical technologies.

Medicare Dependent and Low-Volume Hospitals

The additional payments for Medicare Dependent Hospitals and low-volume hospitals are set to expire.

If the payments expire, the estimated reduction for those affected hospitals is estimated to be $600 million in FY 2023.

Medicare Severity Diagnosis-Related Group

CMS proposes to use the best available data for FY 2023 payment rate updates. As such, CMS proposes to use FY 2021 MedPAR data and FY 2020 cost reports, with certain modifications to address assumptions related to Medicare beneficiaries’ hospital utilization.

As such, to compute Diagnosis Related Group (DRG) relative weights, CMS proposes to calculate and average the results of two sets, one with COVID-19 claims and one without. CMS also proposes to apply a modified methodology in determining the outlier threshold that also factors in assumptions related to Medicare beneficiary utilization in 2023.

Alternatively, CMS seeks comments on using the 2021 data set, without the proposed modifications.

Medicare Wage Index

CMS previously sought comments on whether or not it’s appropriate to apply a hold harmless transition policy in FY 2022 related to geographic delineations from the US Office of Management and Budget (OMB) Bulletin 18-04.

This policy proposal would impact the Medicare payment amount for many hospitals nationwide. As a result of those comments, which included comments about a permanent accommodation, CMS proposes to apply a 5% cap on decreases in wage index values year-over-year regardless of the reason for the decline.

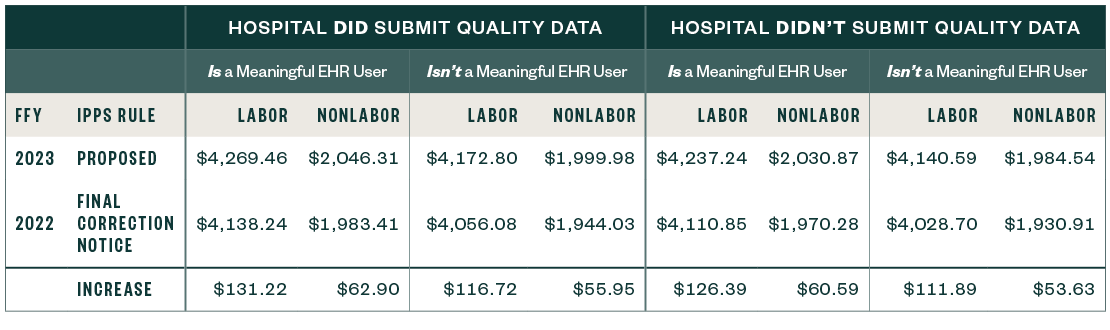

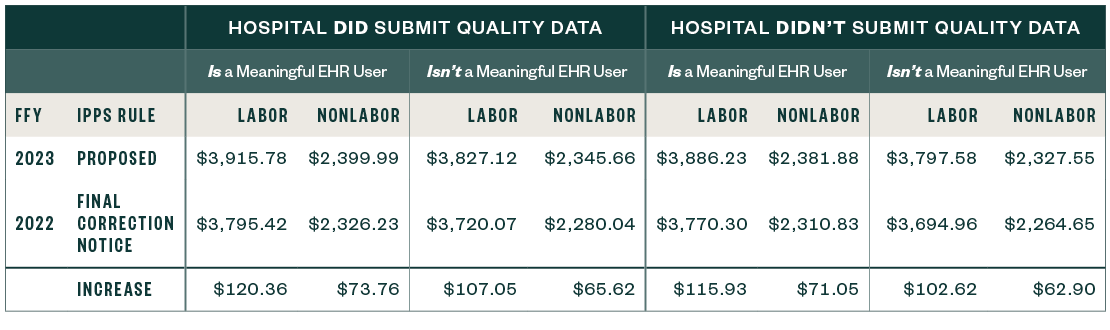

National Adjusted Operating Standardized Amounts

The national adjusted operating standardized amounts are proposed to increase 3.2% with the federal capital payment rate increasing 1.63%, as listed below.

The following metrics align with:

- Whether or not a hospital is a meaningful EHR user

- If a hospital submitted quality data

National Adjusted Operating Standardized Amounts: Labor and Nonlabor

67.6% Labor Share and 32.4% Nonlabor Share, if the Wage Index Is Greater than One

National Adjusted Operating Standardized Amounts: Labor and Nonlabor

62% Labor Share and 38% Nonlabor Share, If the Wage Index Is Less than or Equal to One

Capital Standard Federal Payment Rate

Below are the capital standard federal payment rates for FYs 2022 and 2023.

Graduate Medical Education (GME) and Indirect Medical Education

In conjunction with a statutory review resulting from the decision in the Milton S. Hershey Medical Center case, CMS proposes a modified policy for applying the full-time equivalent (FTE) cap when the weighted count exceeds the cap.

In addition, CMS allows teaching hospitals to enter into Medicare GME affiliation agreements to share and redistribute FTE slots to accommodate rotations. CMS also proposes to allow an urban and a rural hospital participating in the same Rural Training Programs (RTP) to enter an RTP Medicare GME affiliation agreement effective for the academic year beginning July 1, 2023.

Medicare DSH Estimate and Uncompensated Care Payments

CMS proposes updates to the Medicare disproportionate share hospital (DSH) estimate as well as the three factors used to compute uncompensated care (UC) payments.

Medicare DSH Estimate

The estimated Medicare DSH amount for FY 2023 is $13.266 billion, which is $719 million less than the final 2022 estimate. This results in an empirically justified amount of $3.316 billion. The remaining amount is Factor 1, as shown below.

While the starting point of the estimate rolled forward one year, from 2018 cost reports to 2019 cost reports, the actual starting amount changed little—$13.882 billion in 2018 versus $13.808 billion in 2019.

However, significant changes in the updated roll-forward factors used in the estimate drove the number down through the 2023 estimated period. The beginning estimate for hospitals declined significantly compared to 2022.

Uncompensated Care Factors

CMS proposes the following uncompensated care factors for FY 2022:

- Factor 1: $9.949 billion

- Factor 2: 65.71%, as compared to 68.57% in 2022

When applying Factor 2 to Factor 1, the result is a UC pool amount of $6.538 billion to be shared by qualifying hospitals. The 2023 pool is $654 million less than in FY 2022.

CMS proposes to use Line 30 from FY 2018 and FY 2019 Worksheet S-10 data for FY 2023 to determine Factor 3 for all hospitals, except Indian Health Service (IHS) and Puerto Rico hospitals.

For FY 2024, CMS proposes to use the average of the three most recent years for which audited data is available. As an example, for FY 2024, it’s likely to be from FY 2018-2020.

IHS/Tribal Hospitals and Puerto Rico Hospitals

For IHS and Puerto Rico hospitals, CMS proposes to discontinue the use of a low-income insured days proxy and to address significant financial disruption from implementing a new supplemental payment.

CMS proposes to determine Factor 3 for IHS and Tribal hospitals and Puerto Rico hospitals based on the average of the UC data reported on Worksheet S-10 of FY 2018 and FY 2019 cost reports.

CMS proposes a new supplemental payment that would mitigate the anticipated impact on IHS and Tribal hospitals and hospitals located in Puerto Rico from the proposal to discontinue the use of low-income insured days as a proxy for UC costs.

CMS proposes to provide for an additional payment to these hospitals that would be determined based upon the difference between the amount of the UC payment determined for the hospital using Worksheet S-10 data and an approximation of the amount the hospital would have received if CMS continued to use low-income days as a proxy for UC.

Timing and Comment Submission

Hospitals have 60 days from when the FY 2023 IPPS and Long-Term Care Hospital (LTCH) PPS proposed rule first publicly displayed in the Federal Register to:

- Review the Factor 3 table and supplemental data file published on the CMS website

- Notify CMS in writing of issues related to mergers

- Report potential upload discrepancies due to a Medicare Administrative Contractor (MAC) mishandling the Worksheet S-10 data during the report submission process

Comments raising issues specific to the information included in the table and supplemental data file can be submitted to CMS.

Days Associated with Section 1115 Demonstration Projects

In 2020 and 2021, several court cases concluded that Section 1115 waiver days must be included in the DSH calculation under existing regulations. As a result, CMS stated it would revise the regulation to clarify, and further limit, which days can be included in the Medicaid fraction.

Specifically, in the FY 2022 proposed rule, CMS proposed to include only those days in which a patient directly receives inpatient hospital insurance coverage on a Section 1115 waiver. However, CMS didn’t finalize this proposal.

In the FY 2023 proposed rule, CMS again proposes changes to the regulations. Section 1115 waiver days to be included in the DSH calculation if:

- Applicable on days patients receive hospital health insurance that provides essential health benefits

- Covered with hospital health insurance bought with premium assistance equal to at least 90% of the cost of the health insurance

- Covered patient isn’t also entitled to Medicare Part A